The European energy crisis in 2022 reshaped global LNG flows, with higher prices drawing cargoes from around the globe to the now gas-starved continent. US LNG has played a particularly important role in filling the gap. In 2021, 34% of US LNG exports went to Europe. In 2022, nearly 70% did, meeting 15% of total European gas demand.

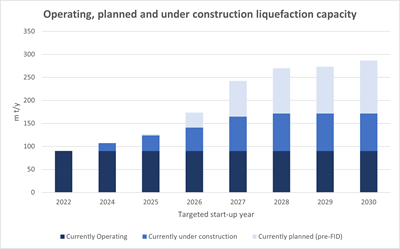

The past two years have seen many LNG projects advance as US companies rush to take advantage of European demand. Since the beginning of 2022, five projects in the US representing 66mt/yr of capacity have taken FID. In combination with the Golden Pass LNG project, which has been under construction since 2019, a 91% increase in US LNG capacity over present levels is now baked in. The US is already set to edge out Qatar as the world’s largest LNG producer in 2023. By 2030, that gap will widen significantly even as Qatar completes its own massive LNG expansion projects.

This US build-out will shape gas markets across the world. But there are uncertainties concerning both when projects already under construction come online and how many of the approximately 120mt/y US projects eyeing FID eventually move forward.

One source of risk is the very size of the US build-out. Between 2000 and 2020, the largest five-year build-out of US liquefaction capacity occurred from 2015-19, when 75mt/yr of additional capacity was added. As of now, 82mt/yr of liquefaction capacity is already under construction, with another wave of projects on the way. Projects outside the US (c.120mt/yr of new capacity is currently under construction) will further strain the global LNG supply chain.

As more projects try to begin construction at once, labour supply and the LNG construction supply chain risk being overstretched. Even projects where construction is currently underway risk seeing their start dates slip six months to a year. Projects now attempting to start construction are unlikely to meet aggressive timelines for project start up and should expect to pay higher prices compared to earlier projects.

Those US projects that are yet to take FID also face regulatory risks. The past year has seen the Department of Energy (DOE) change its approach to US LNG projects. Traditionally, the agency has wielded its oversight power with a light hand. But in May 2023, the DOE announced a new policy requiring projects to have both "physically commenced construction" on a project and demonstrated that the project delay is due to "extenuating circumstances outside of [the project's] control" to extend their export commencement deadlines.

The agency is also yet to approve Commonwealth LNG’s export licence almost a year after the project received FERC approval. Past projects have seen DOE export licences granted within only a few months of obtaining FERC approval. If this is indicative of the DOE adopting an aggressive stance on regulating LNG terminals, projects that are otherwise well placed to take FID may face significant delays or be stopped altogether. The DOE itself has not formally announced a substantial policy change beyond its new approach to commencement deadline extensions, requiring projects to have begun substantial construction to obtain one.

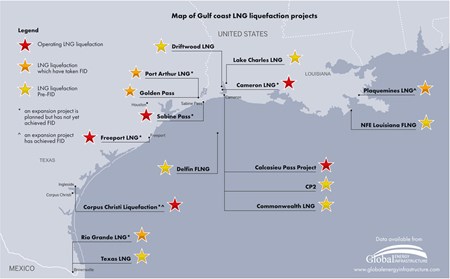

Three US projects look to be approaching FID as part of a next wave of projects: Venture Global’s Calcasieu Pass 2 (CP2) facility, Delfin Midstream’s first FLNG vessel and the independent Commonwealth LNG terminal. Together, the projects represent 23mt/yr of LNG capacity. All three projects have obtained FERC approval (in the case of Delfin FLNG, MARAD approval) and have either secured or are close to securing the offtake and tolling agreements needed to support FID.

The projects have also seen a burst of momentum in the past several months, with Commonwealth LNG and Delfin FLNG signing financing and offtake agreements as well as heads of agreements that may be firmed up soon, and CP2 securing FERC environmental approval.

CP2 and Commonwealth LNG will want to secure DOE approval before taking FID. Delfin LNG will need to decide if it wants to take FID in the hope that physically commencing construction will enable it to secure a necessary extension to its current commencement deadline or if it will simply apply for a new export licence, heavily delaying the project. The fate of these projects will do a great deal to help clarify the DOE's position going forward.

Even if projects are only delayed, that may be enough to kill them due to the uncertain trajectory of global gas demand. As the energy transition continues, gas demand in mature markets is at constant risk of entering terminal decline. At the same time, growing global LNG liquefaction capacity means that the end of the decade will see a softer market. Big terminals take more than a decade to pay off, and late arrivals risk beginning production too late.

2024 could see another 25-35mt/yr of US LNG capacity reach FID, but as risks stack up, it may be the last wave to move forward.

Global Energy Infrastructure provides exclusive global project data across LNG, hydrogen, CCS, oil & gas pipelines and refining & petrochemicals. For more, click here.

This article was published as part of PE Outlook 2024, which is available for subscribers here. Non-subscribers can purchase a copy of the digital edition here.

Comments