Broker launches insurance against carbon leakage

London-based Howden says new product can boost bankability of CCS projects by addressing key risk

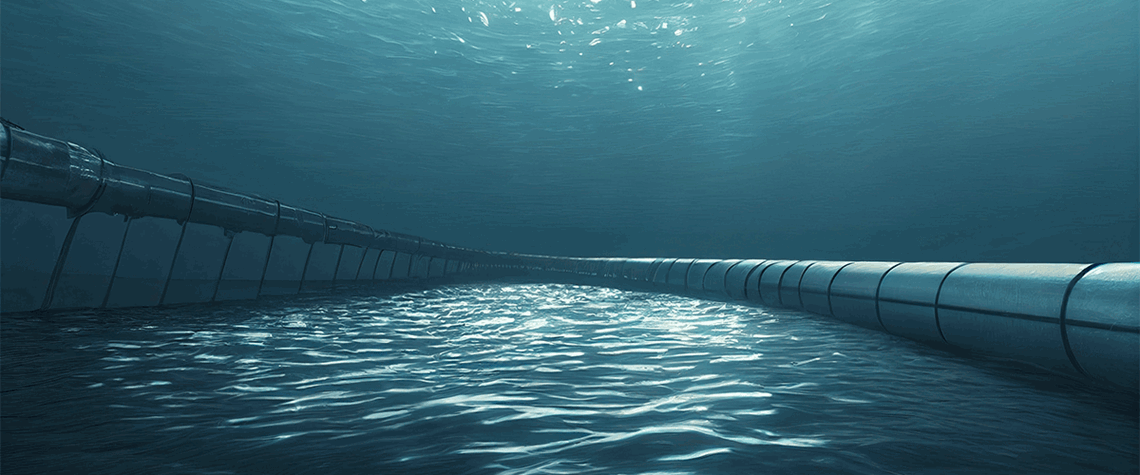

London-based broker Howden has launched an insurance facility covering leakage of CO₂ from commercial-scale CCS projects in a move designed to help unlock investment by addressing one of the sector’s key risks. The insurance facility, which Howden says is the first of its type, provides cover for environmental damage and loss of revenue arising from the sudden or gradual leakage of CO₂ from CCS projects into the air, land and water. Leakage could lead to CCS projects being unable to fulfil emission reduction commitments made against offsets or allowances issued in cap-and-trade markets. The insurance product is also designed to support the development of a commercial insurance market for lea

Also in this section

21 July 2024

Awards experience 20% increase in nominations this year, with submissions from 27 countries

18 July 2024

Platform developed at Scottish university uses advanced simulations and machine learning to find most cost-effective and sustainable combinations of materials for use in carbon capture

18 July 2024

Stockholm Exergi agrees to one of world’s largest deployments of CO₂ liquefication technology to enable transport of emissions captured from biomass power plant

11 July 2024

Watkins will leverage her financial acumen and strategic insight to lead Gulf’s commercial initiatives across media, events, and market intelligence