The Russia-Ukraine conflict and the ongoing energy commodity price volatility have catalysed faster momentum to adopt low-carbon technologies. Volatile market conditions sparked by Russia’s invasion of its neighbour have driven up the wholesale price of gas and, subsequently, electricity owing to the role of gas in setting the benchmark price for electricity. We highlight that the energy security issues around the exposure of markets to imported energy are rising and that this will disproportionately impact markets that relied heavily on what were previously cheaper energy imports.

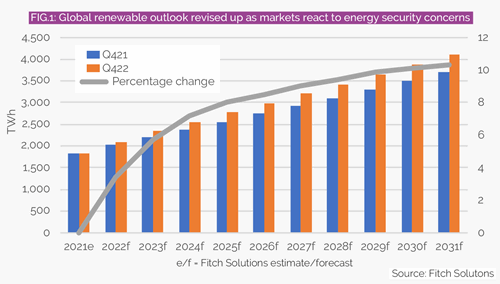

We have seen a sharp reversal in our forecasts for gas generation in Europe that will be offset by a more rapid deployment of renewables. Our analytical teams have tracked increasing momentum behind growth strategies being employed by many markets that have significantly improved our growth outlook for renewables. Fig.1 outlines our change in expectations from the end of 2021 against our current view.

The EU has been seeking ways to accelerate renewable power development across member states. The European Commission has increased the renewable energy target from 40pc to 45pc by 2030. In response to the Russian invasion of Ukraine, the EU announced a strategy to diversify energy supplies and promote renewables growth, dubbed RepowerEU. The plan outlines a ‘new energy compact’ by which funding support from the European Green Deal will be frontloaded to speed up non-hydropower renewables capacity growth while development processes are also to be accelerated.

We have seen a raft of new support schemes across the region, with many looking to reduce development times for renewables, increase subsidy support and simplify and relax permitting and licensing processes. For example, the UK is looking to scale back its gas sector in favour of a faster rollout of offshore wind to reduce development times from four years to just one.

In response to the ongoing crisis, Germany’s government has adopted a draft finance plan for the Climate and Transformation Fund, which sets out funding of €177.5bn ($179.9bn) over 2023–26, aimed at climate action and the transition to a green economy. Funding of €35.5bn has been set out for subsidising the renewables levy as Germany works to reduce record-high electricity prices, with consumers no longer paying the levy from 1 July 2022.

We also highlight the re-emergence of the US as a major partner for low-carbon energy development with new partners in the Middle East. The White House announced that the US and the UAE have agreed a new sustainable energy development framework known as the Partnership for Accelerating Clean Energy (Pace). The two countries hope to mobilise $100bn in global investment in the industry and enable progress toward the objective of deploying 100GW of clean energy worldwide by 2035. Pace’s top priorities are “a global clean energy future and long-term energy security”.

Governments are increasingly focused on more locally sourced energy and, in many cases, this has added to the momentum to adopt low-carbon technologies. We expect this to become increasingly pertinent, for regions such as Europe, which had benefitted from low-cost Russian gas, to create a competitive economic environment for many industries. With prices high, there is a rising risk that industrial competitiveness in the region will slide, weakening economic performance.

We have also seen a sharp rise in the adoption of low-carbon hydrogen as a decarbonisation strategy. It was recently announced by the Singaporean Ministry of Trade and Industry that, in addition to decarbonising industries such as shipping and aviation, hydrogen gas will be developed to meet up to half of the nation’s energy needs by 2050. We highlight that many Asia-Pacific markets will look towards hydrogen and its derivatives as a new source of low-carbon power that may supplement their energy needs and reduce the demand for natural gas supply in the long term.

We are tracking a vast increase in the announcement of green hydrogen production projects, with the pipeline rising from approximately 150 commercial 10MW-plus projects to just under 400 between Q4 2021 and today. However, we do not expect that all the projects will move forwards, with many struggling to reach FID. We highlight that significant challenges remain to the adoption of a sustainable hydrogen economy, which in many cases revolves around a core issue of around establishing suitably bankable offtake contracts.

The EU has set out a strategy for the adoption of hydrogen in the industry for 2030 with a target of 20mn t, roughly a quarter of the total volume produced in the current market. While we do not expect this target will be met over the coming decade, we do highlight its significance in accelerating development of the low-carbon fuel.

We expect demand will rise well above current levels by 2030 as more offtakers begin to ‘couple’ with hydrogen. This will involve the displacing of the incumbent grey hydrogen industry, which will be challenging on a cost basis without support for uptake of green hydrogen—currently several times more expensive. Overcoming the dominance of an incumbent industry such as the ammonia sector will involve its own challenges. Achieving a cost-competitive price for hydrogen and ammonia will serve to address some of the major challenges facing the economics of the pivot away from traditional fossil fuels. However, the rate at which costs will decline remains in question, and the adoption of a more expensive fuel amid a period of economic turbulence will be complicated.

Thomas van Lanschot is the head of power and low carbon energy at Fitch Solutions.

This article is part of our special Outlook 2023 report, which features predictions and expectations from the energy industry on key trends in the year ahead. Click here to read the full report

Comments