Avaada receives $1bn from Brookfield for Indian green hydrogen and ammonia

The developer is in advanced discussions with potential investors toward an additional $200mn

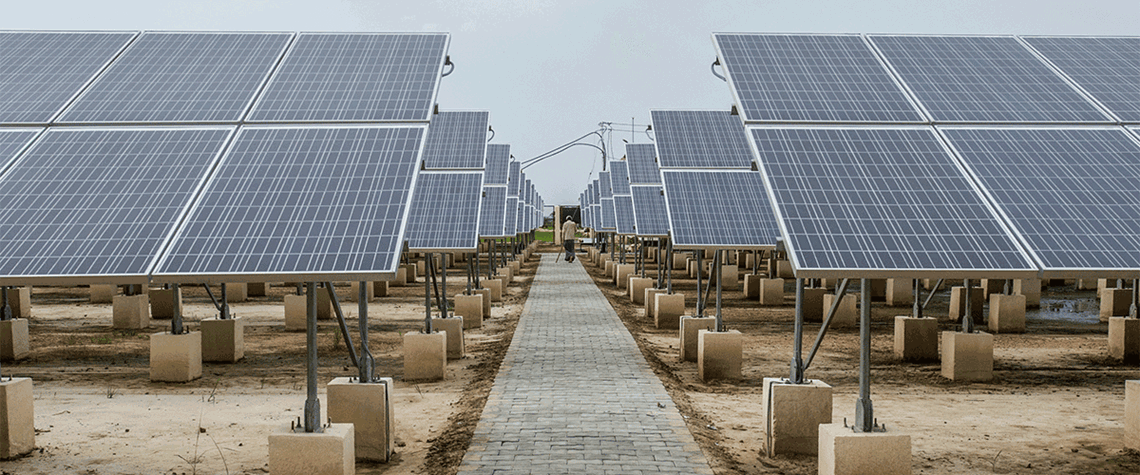

Indian renewable energy company Avaada has secured $1bn in investment from clean energy investor Brookfield Renewable and $68mn from Thai power company Global Power Synergy Public Company towards its green hydrogen and ammonia ventures. The firm plans to raise $1.3bn and claims to be in “advanced discussions” with potential investors on securing an additional $200mn. Avaada operates 4GW of renewable energy—primarily utility solar—with plans to expand to 11GW by 2026. Last year, the firm signed a memorandum of understanding with the state government of Rajasthan to develop a INR400mn ($4.89mn) green ammonia plant. $1.3bn – Target fundraise “We are pleased to be investing in Avaada thr

Also in this section

14 January 2026

Continent’s governments must seize the green hydrogen opportunity by refining policies and ramping up the development of supply chains and infrastructure

6 January 2026

Shifts in government policy and rising power demand will shape the clean hydrogen sector as it attempts to gain momentum following a sluggish performance in 2025

23 December 2025

Government backing and inflow of private capital point to breakthrough year for rising star of the country’s clean energy sector

19 December 2025

The hydrogen industry faces an important choice: coordinated co-evolution or patched-together piecemeal development. The way forward is integrated co-evolution, and freight corridors are a good example