Hystar secures $26mn in series B

Norwegian PEM electrolyser manufacturer plans to have gigawatt-scale production capacity in place by 2025

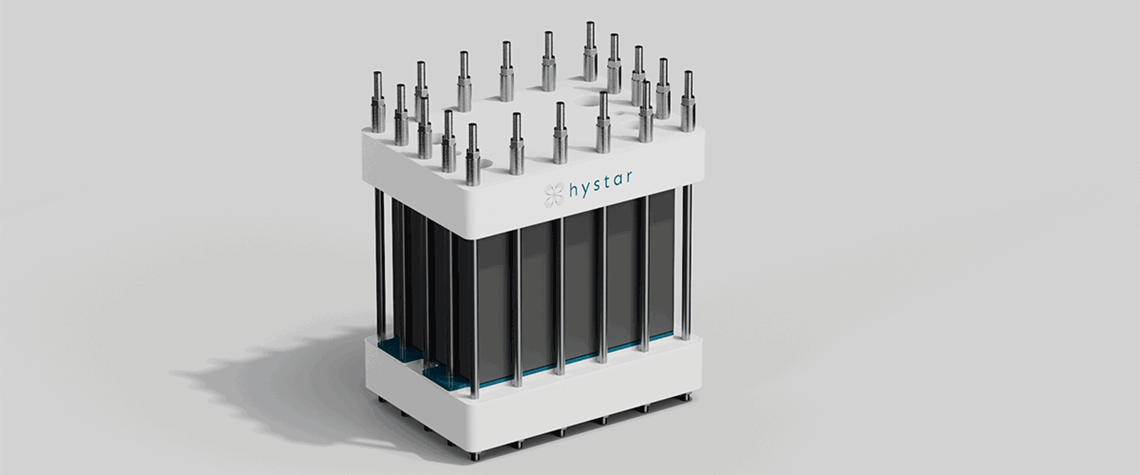

Norwegian proton-exchange-membrane electrolyser manufacturer Hystar has secured $26mn in a series B funding round co-led by venture capital firm AP Ventures and Japanese conglomerate Mitsubishi. Additional investors in the round include Belgium-based Finindus, Japan’s Nippon Steel Trading, private equity firm Hillhouse Investment and Shanghai-headquartered Trustbridge Partners, as well as existing investors venture capital firm Sintef Ventures and investment company Firda. Hystar aims to use the capital to scale up commercial operations, with an automated gigawatt-capacity production line in place by 2025. $26mn – Series B funding Last year, Hystar raised NOK50mn ($5mn) in a funding

Also in this section

14 January 2026

Continent’s governments must seize the green hydrogen opportunity by refining policies and ramping up the development of supply chains and infrastructure

6 January 2026

Shifts in government policy and rising power demand will shape the clean hydrogen sector as it attempts to gain momentum following a sluggish performance in 2025

23 December 2025

Government backing and inflow of private capital point to breakthrough year for rising star of the country’s clean energy sector

19 December 2025

The hydrogen industry faces an important choice: coordinated co-evolution or patched-together piecemeal development. The way forward is integrated co-evolution, and freight corridors are a good example