HH2E taps Nel for Lubmin electrolysers

The Norwegian manufacturer has signed a letter of intent to provide a potential 120MW of capacity to the German developer

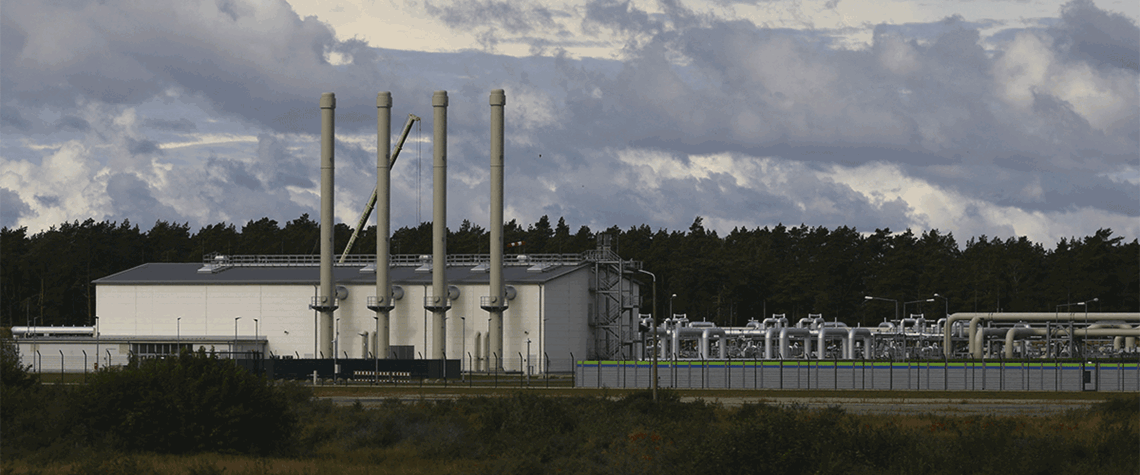

German hydrogen project developer HH2E has signed a letter of intent with Norwegian electrolyser manufacturer Nel for a Feed study and potential supply of 120MW of electrolyser capacity. HH2E is developing a green hydrogen project at Germany’s Baltic Sea port of Lubmin—the entry point to Germany of the now-halted Nord Stream natural gas pipeline from Russia. The project will use a combination of renewables and a 200MWh high-capacity battery to continuously power alkaline electrolysers. 2025 – Scheduled startup for Lubmin project The developer has scheduled construction of the 6,000t/yr first phase to begin this year, with the aim to start production in 2025. A second-phase expansion

Also in this section

14 January 2026

Continent’s governments must seize the green hydrogen opportunity by refining policies and ramping up the development of supply chains and infrastructure

6 January 2026

Shifts in government policy and rising power demand will shape the clean hydrogen sector as it attempts to gain momentum following a sluggish performance in 2025

23 December 2025

Government backing and inflow of private capital point to breakthrough year for rising star of the country’s clean energy sector

19 December 2025

The hydrogen industry faces an important choice: coordinated co-evolution or patched-together piecemeal development. The way forward is integrated co-evolution, and freight corridors are a good example