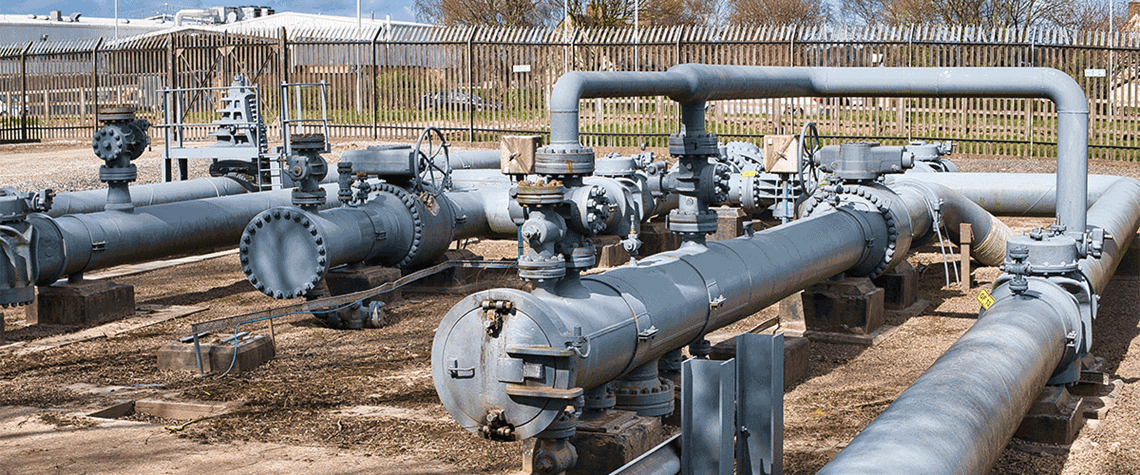

UK risks falling behind on hydrogen gas network

Trade association calls for regulated asset base mechanism to support rollout of hydrogen pipelines

The UK must accelerate the creation of a regulatory framework for hydrogen transportation and storage via gas networks, according to trade association Hydrogen UK. The government is consulting on a potential support scheme for hydrogen transportation and storage, which is likely to mimic the framework that exists for UK gas networks. Gas infrastructure is supported by a regulated asset base (RAB) model, which provides a fixed return during construction rather than operation. Hydrogen UK has come out in favour of this model for both growth and steady-state phases of infrastructure development. “However, RAB would have to be supplemented with an additional external funding mechanism due to the

Also in this section

14 January 2026

Continent’s governments must seize the green hydrogen opportunity by refining policies and ramping up the development of supply chains and infrastructure

6 January 2026

Shifts in government policy and rising power demand will shape the clean hydrogen sector as it attempts to gain momentum following a sluggish performance in 2025

23 December 2025

Government backing and inflow of private capital point to breakthrough year for rising star of the country’s clean energy sector

19 December 2025

The hydrogen industry faces an important choice: coordinated co-evolution or patched-together piecemeal development. The way forward is integrated co-evolution, and freight corridors are a good example