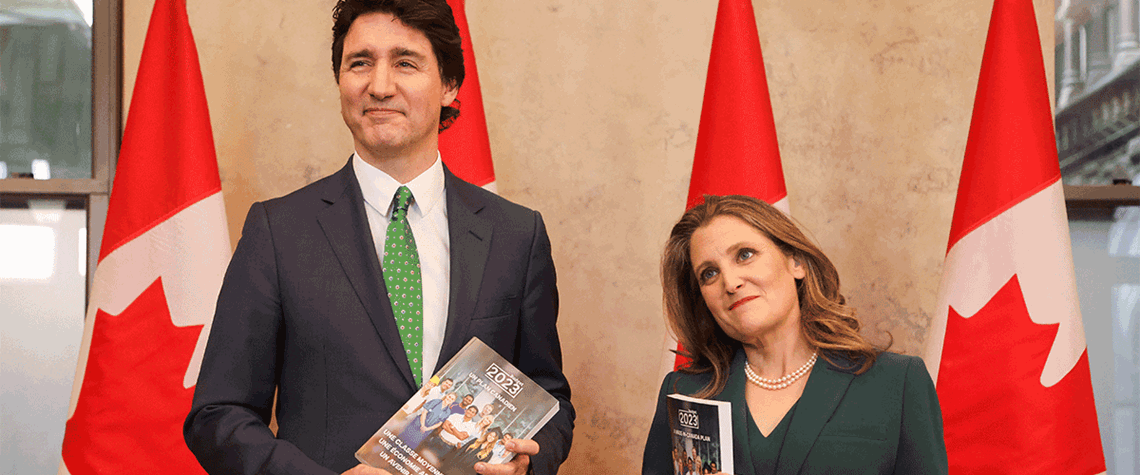

Canada unveils hydrogen investment tax credit

Projects seeking full rate must have carbon intensity below 4kg of CO₂/kg of hydrogen produced and meet labour requirements

Canada has included an investment tax credit for hydrogen production based on lifecycle carbon intensity in its 2023 federal budget. The maximum support covers 40pc of eligible project costs if carbon intensity is below 0.75kg of CO₂/kg of hydrogen produced, while the minimum covers 15pc of costs for projects with carbon intensity 2–4kg of CO₂/kg of hydrogen produced. Canada plans to calculate carbon intensity on a ‘cradle-to-gate’ basis, accounting for upstream emissions through to the point hydrogen exits the facility. As hydrogen is a zero-carbon gas, downstream emissions after production will not be considered, the government says. Projects converting low-carbon hydrogen to ammonia would

Also in this section

24 April 2024

Demand for energy purposes to outpace feedstock applications by the 2040s as government policies drive consumption, says DNV

24 April 2024

Danish firm joins growing list of European electrolyser manufacturers establishing production in US as IRA incentives prove strong draw

19 April 2024

UAE renewables developer weighs opportunities to join green hydrogen projects in US and Canada, Andreas Bieringer, director of green hydrogen business development and commercial, tells Hydrogen Economist

17 April 2024

Building green hydrogen ports and lower production costs key to becoming global exporter