21 March 2018

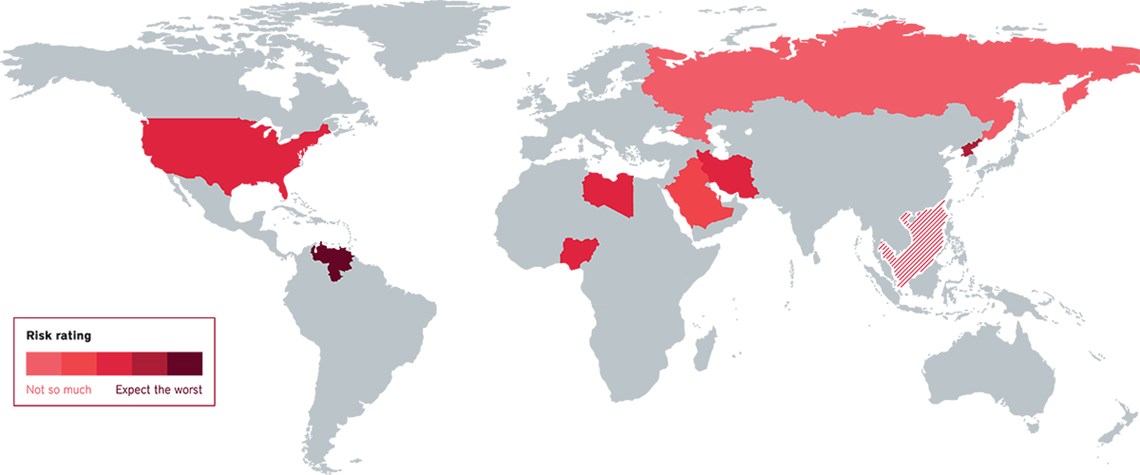

The volatile 10

As the oil market regains balance, risk will affect the price. Here's where to watch

US Unpredictable leader? Global risk now emanates directly from the Oval Office and—on everything from North Korea to Nafta—Donald Trump's Twitter account. For the oil market, the president is broadly bullish. US tax cuts may feed into higher demand; Trump's dislike of the Iran deal and stance on Venezuela may bring sanctions; and an implicit soft-dollar policy could support oil prices. His "American first" programme has not caused the drop in global trade some feared. The main bearish risk from the US comes from the Fed's planned interest-rate rises this year and the impact on the global economy. If Democrats win bigly in November's midterm elections, Trump will be stymied and the Russia in

Also in this section

26 July 2024

Oil majors play it safe amid unfavourable terms in latest oil and gas licensing bid rounds allowing Chinese low-ball moves

25 July 2024

Despite huge efforts by India’s government to accelerate crude production, India’s dependency shows no sign of easing

24 July 2024

Diesel and jet fuel supplies face a timebomb in just four years, and even gasoline may not be immune

23 July 2024

Rosneft’s Arctic megaproject is happening despite sanctions, a lack of foreign investment and OPEC+ restrictions. But it will take a long time for its colossal potential to be realised