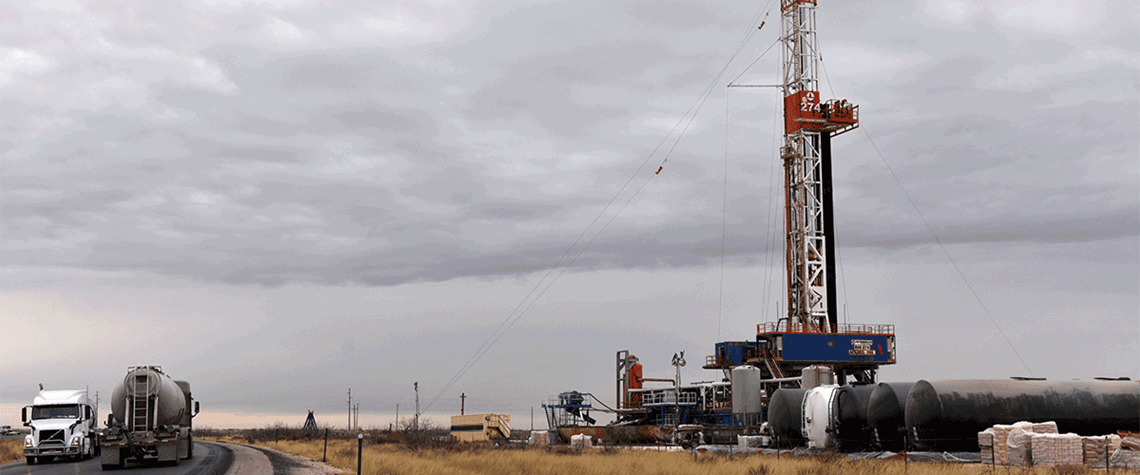

US shale response to oil price boost may be muted

Behind the rig count data lie differences between public and private operators, acreage questions, the lure of returns and unwavering capital discipline

The US’ active oil and gas rig count has generally been trending downwards since the end of April even as crude prices have been creeping up in recent weeks after holding relatively steady earlier in the year. The combined oil and gas rig count fell from 755 on 28 April to 641 on 15 September, according to Baker Hughes, with oil-focused rigs declining from 591 to 515. However, the Baker Hughes data from the latest three weeks in that period suggest the decline may be turning, with the total count falling by only one, to 631, with the total count fluctuating between 632 and 631 for three weeks before rising to 641, though it remains to be seen whether this will hold. Oil rig counts typically

Also in this section

28 January 2026

The alliance looks to bolster market management credibility by bringing greater clarity and unity to output cuts and producer capacity later in 2026

23 January 2026

A strategic pivot away from Russian crude in recent weeks tees up the possibility of improved US-India trade relations

23 January 2026

The signing of a deal with a TotalEnergies-led consortium to explore for gas in a block adjoining Israel’s maritime area may breathe new life into the country’s gas ambitions

22 January 2026

As Saudi Arabia pushes mining as a new pillar of its economy, Saudi Aramco is positioning itself at the intersection of hydrocarbons, minerals and industrial policy