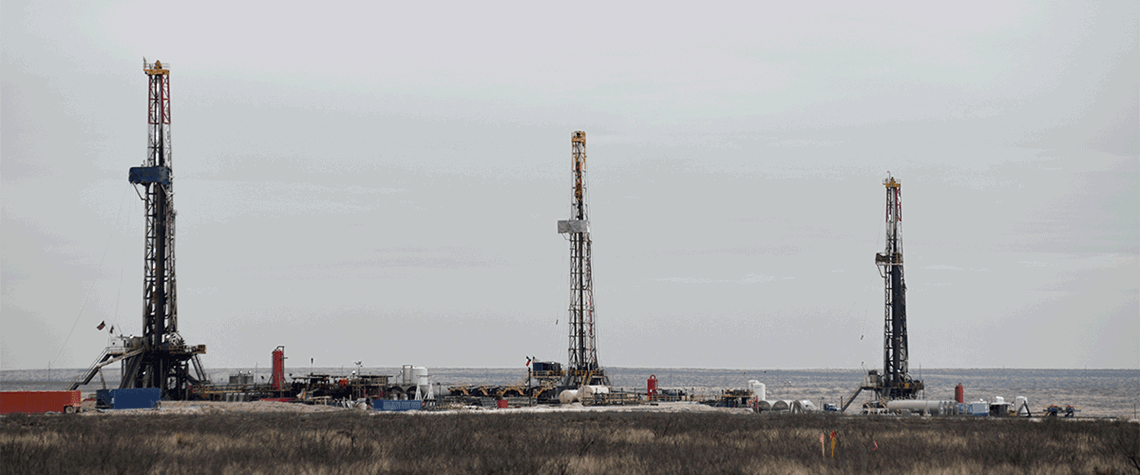

US shale starts 2023 in ‘realistic’ mood

First-quarter shale results show ongoing restraint amid signs of cost deflation

The first-quarter earnings season has highlighted signs of improved capital spending in the US, while certain tight oil producers have flagged up signs of cost deflation in oilfield services and equipment. Meanwhile, lower gas prices have caused producers in gas-rich basins to scale back operations, while oil prices—which have also declined since 2022—remain strong enough to support activity. Consultancy Wood Mackenzie notes in a report rounding up results among 42 US independents that WTI prices averaged $76/bl in the first quarter of 2023. This is “much closer to a ‘mid-cycle’ level than last year’s average of $96/bl”, it says. “Mid-cycle is not a hard and fast number, but that is generall

Also in this section

23 January 2026

A strategic pivot away from Russian crude in recent weeks tees up the possibility of improved US-India trade relations

23 January 2026

The signing of a deal with a TotalEnergies-led consortium to explore for gas in a block adjoining Israel’s maritime area may breathe new life into the country’s gas ambitions

22 January 2026

As Saudi Arabia pushes mining as a new pillar of its economy, Saudi Aramco is positioning itself at the intersection of hydrocarbons, minerals and industrial policy

22 January 2026

New long-term deal is latest addition to country’s rapidly evolving supply portfolio as it eyes role as regional gas hub