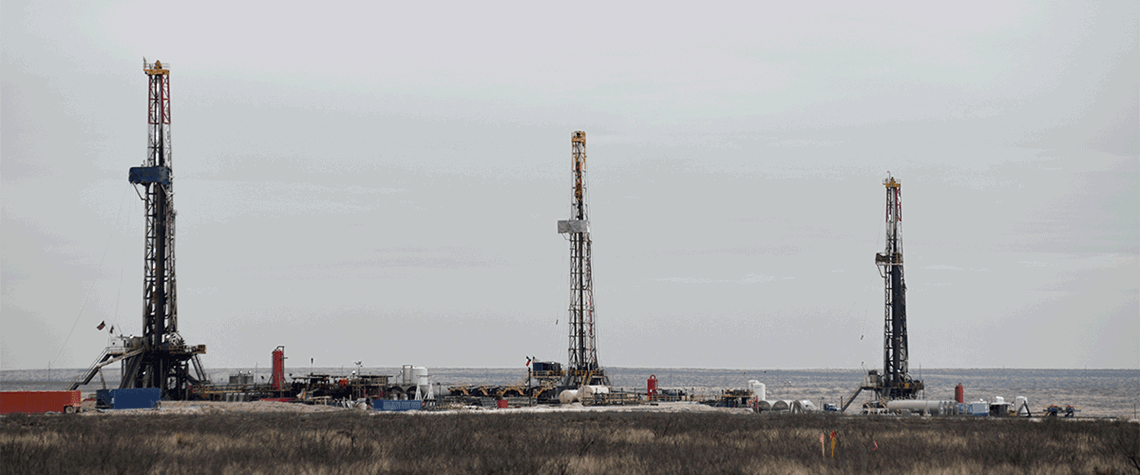

US shale starts 2023 in ‘realistic’ mood

First-quarter shale results show ongoing restraint amid signs of cost deflation

The first-quarter earnings season has highlighted signs of improved capital spending in the US, while certain tight oil producers have flagged up signs of cost deflation in oilfield services and equipment. Meanwhile, lower gas prices have caused producers in gas-rich basins to scale back operations, while oil prices—which have also declined since 2022—remain strong enough to support activity. Consultancy Wood Mackenzie notes in a report rounding up results among 42 US independents that WTI prices averaged $76/bl in the first quarter of 2023. This is “much closer to a ‘mid-cycle’ level than last year’s average of $96/bl”, it says. “Mid-cycle is not a hard and fast number, but that is generall

Also in this section

26 July 2024

Oil majors play it safe amid unfavourable terms in latest oil and gas licensing bid rounds allowing Chinese low-ball moves

25 July 2024

Despite huge efforts by India’s government to accelerate crude production, India’s dependency shows no sign of easing

24 July 2024

Diesel and jet fuel supplies face a timebomb in just four years, and even gasoline may not be immune

23 July 2024

Rosneft’s Arctic megaproject is happening despite sanctions, a lack of foreign investment and OPEC+ restrictions. But it will take a long time for its colossal potential to be realised