Shell demonstrates renewed focus on hydrocarbons

Gulf of Mexico moves suggest cautious optimism in region’s deep waters, with a shift to work smarter and balance risks

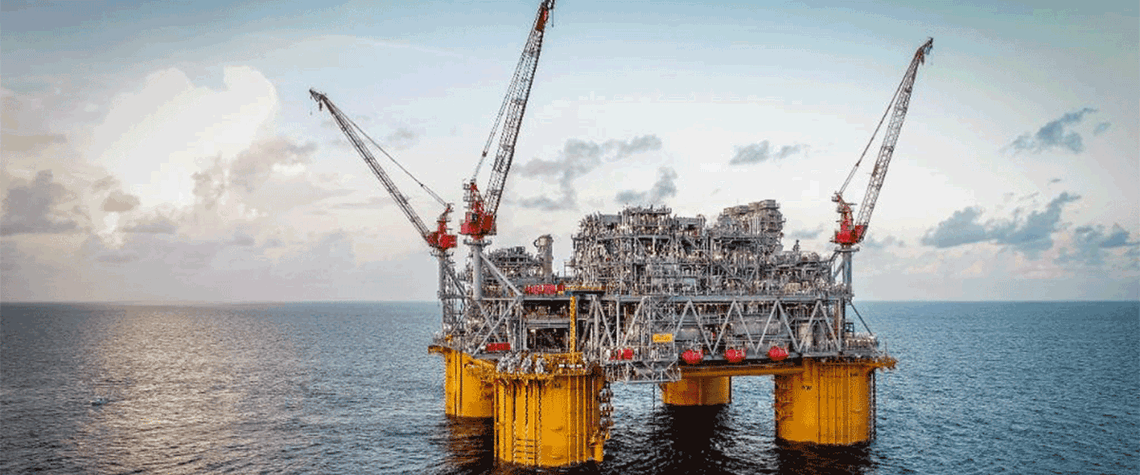

Two FIDs in quick succession by Shell in the US Gulf of Mexico (GOM) demonstrate the major’s renewed focus on oil and gas. In mid-December, Shell announced an FID on a phased campaign to add three wells in the Great White unit, boosting production at the company’s Perdido spar. This was followed later in December by the announcement that Shell and partner Norway’s Equinor had taken FID on Sparta, which will be Shell’s 15th deepwater platform in the GOM. The FIDs also illustrate the continuing trends in deepwater drilling. Some operators have remained hesitant to pursue new deepwater exploration, opting instead to expand production at existing platforms by drilling new wells in already produc

Also in this section

23 January 2026

A strategic pivot away from Russian crude in recent weeks tees up the possibility of improved US-India trade relations

23 January 2026

The signing of a deal with a TotalEnergies-led consortium to explore for gas in a block adjoining Israel’s maritime area may breathe new life into the country’s gas ambitions

22 January 2026

As Saudi Arabia pushes mining as a new pillar of its economy, Saudi Aramco is positioning itself at the intersection of hydrocarbons, minerals and industrial policy

22 January 2026

New long-term deal is latest addition to country’s rapidly evolving supply portfolio as it eyes role as regional gas hub