On 17 August, the UK published its Hydrogen Strategy, which outlines the steps the government intends to take over the next decade and beyond to develop the country’s hydrogen industry.

The government considers the adoption of hydrogen as a core component for delivering emissions reductions and intends for the UK to become a global hydrogen leader by 2030.

This will be achieved by adopting a ‘twin-track’ approach to producing hydrogen and a ‘whole-system’ approach to developing the wider hydrogen industry.

Twin-track

The ‘twin-track’ approach involves supporting both green and blue hydrogen production. Supporting a variety of production methods is seen by the government as the most practical approach to deliver the amount of hydrogen required to meet net zero.

In addition, the UK’s existing skills, capabilities, assets and infrastructure give the nation the potential to excel at both green and blue hydrogen production.

The UK aims to quadruple offshore wind capacity to 40GW by 2030—which will support the production of green hydrogen. Meanwhile the UK’s geology is favourable for large scale storage of carbon dioxide in both salt caverns and disused oil and gas fields, which is required for blue hydrogen production.

Whole-system

The government’s aim to develop a hydrogen economy in the UK is intended to be achieved via a holistic or ‘whole-system’ approach, which will involve developing the entire hydrogen value chain during the 2020s.

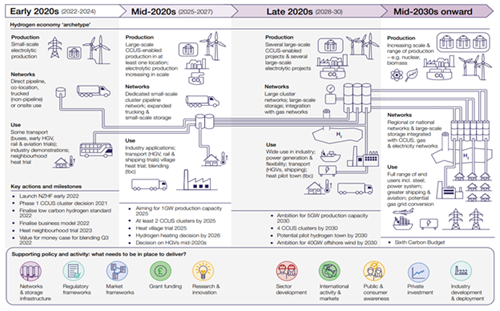

This is a welcome approach, as developing supply, demand and associated infrastructure in parallel is likely to result in a more sustainable hydrogen industry. The government’s 2020s roadmap (see Fig.1) sets out its vision for how the hydrogen economy will develop over this period.

Together the ‘twin-track’ and ‘whole-system’ approaches set out the framework by which the government intends to develop the hydrogen industry, and this framework is supported by the following key commitments which are further detailed in the strategy:

Production

- Ambition for 5GW of low-carbon (green and blue) hydrogen production capacity by 2030.

- A £240mn ($327mn) Net Zero Hydrogen Fund to be established in early 2022. The fund will provide co-investment in hydrogen production projects.

- Detailed production strategy to be published in early 2022.

Networks and storage

- Call for evidence on the future of the gas system to be launched in 2021. This will enable market participants to provide input on how hydrogen can be integrated into existing gas systems and future network development.

- Systemic hydrogen network and storage requirements review, with an update in early 2022, which will consider whether funding, other incentives or further regulation are required to ensure that necessary storage infrastructure is available when required.

- A £68mn Longer Duration Energy Storage Demonstration competition, which aims to accelerate commercialisation of long-duration energy storage projects. Storing hydrogen produced from excess electricity will be a key component of grid flexibility.

- A £60mn Low Carbon Hydrogen Supply 2 competition, which aims to support demonstration projects including hydrogen storage and supply solutions.

Use of hydrogen

- Phase 2 of the £315mn Industrial Energy Transformation Fund, which will support the uptake of technologies that improve efficiencies and reduce carbon emissions from industrial processes. Hydrogen will be included as a fundamental part of this.

- Cluster project development. Due to infrastructure requirements, hydrogen demand is likely to initially be concentrated in large industrial clusters. These industrial clusters can act as ‘pathfinder’ sites to demonstrate the viability of hydrogen as a fuel at a commercial scale and foster an initial market close to the site(s) of supply.

- Flexible power generation with hydrogen being used in gas peaker plants. Government analysis suggests a demand of up to 10TWh for hydrogen power in 2030.

- Hydrogen heating trials will be conducted using 100pc hydrogen, with a neighbourhood trial by 2023, a large village scale trial by 2025 and a potential pilot town trial by the end of the decade.

- Zero Emission Bus Regional Areas scheme will provide up to £120mn to fund zero-emissions buses, including both hydrogen and battery electric.

Creating a market

- The revenue mechanism, which will provide funding for the Hydrogen Business Model, will be published in 2021 as part of the Hydrogen Business Model.

- The Hydrogen Business Model is intended to provide longer-term revenue support to overcome the cost gap between low-carbon hydrogen and higher-carbon counterfactual fuels. A response to consultation and indicative heads of terms is expected to be published in Q1 2022.

- Demand side interventions such as carbon pricing, Low Carbon Hydrogen Standard and sector-specific policies will be developed with a strategy update in early 2022.

Welcome Development

The strategy is a welcome development for the UK hydrogen sector. The level of detail and clear targets demonstrate the government is committed to developing the industry in this decade and beyond.

At present, we consider the UK hydrogen industry to be in a nascent stage of development. While many small-scale or pilot projects are under development, larger-scale projects remain limited.

Larger-scale development in the hydrogen industry is likely to be conditional upon certainty around governmental policy support mechanisms, in particular the Hydrogen Business Model and its revenue mechanism, as this will be required before companies will take FIDs.

In addition, the development of the Low Carbon Hydrogen Standard and confirmation of the treatment of low-carbon hydrogen under the proposed amendments to the Renewable Transport Fuels Obligation will be critical if low carbon hydrogen production at scale is to become a reality. We expect to see further policy details published in 2022 and will provide updates in due course.

For any questions, please contact the authors.

Comments