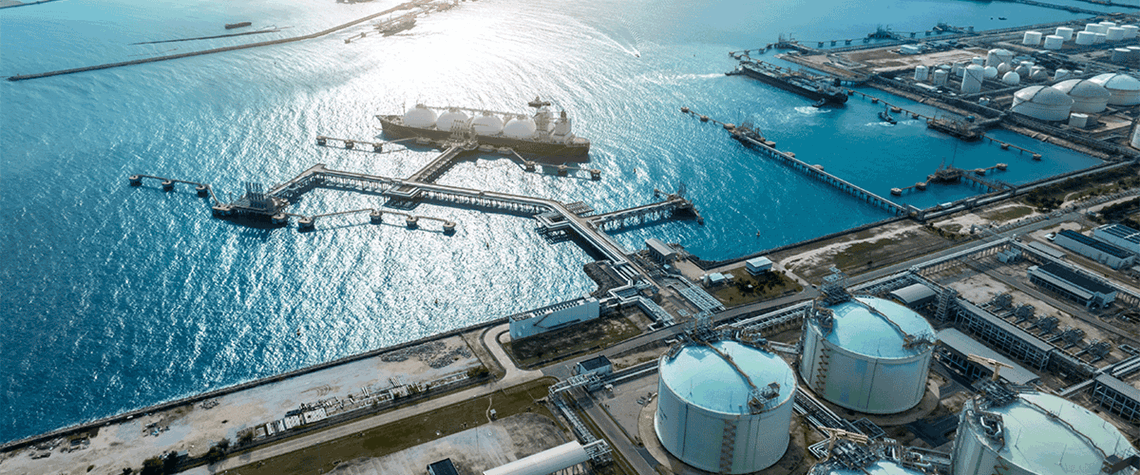

Outlook 2024: Building LNG’s resilience through turbulent times

Larger and more diversified portfolios are best placed to navigate through volatility

The global LNG industry is thriving. A record 200mt/yr of new supply is under construction as players bet big on Asia’s push to reduce its dependence on coal and Europe’s need to replace Russian gas. Given the urgency of the energy transition, an increasingly fractious geopolitical system and concerns over global economic growth, could the LNG industry have bitten off more than it can chew? In this article, we explore some of the market and external risks that players need to grapple with and consider how they can prosper through turbulent times. Is there too much LNG under construction? In short, no. Increased supply availability will bring prices down and boost demand growth. In our latest

Also in this section

5 March 2026

Gas is a central pillar of Colombia’s energy system, but declining production poses a significant challenge, and LNG will be increasingly needed as a stopgap. A recent major offshore gas discovery offers hope, but policy improvements are also required, Camilo Morales, secretary general of Naturgas, the Colombian gas association, tells Petroleum Economist

4 March 2026

The continent’s inventories were already depleted before conflict erupted in the Middle East, causing prices to spike ahead of the crucial summer refilling season

4 March 2026

The US president has repeatedly promised to lower gasoline prices, but this ambition conflicts with his parallel aim to increase drilling and could be upended by his war against Iran

4 March 2026

With the Strait of Hormuz effectively closed following US-Israel strikes and Iran’s retaliatory escalation, Fujairah has become the region’s critical pressure release valve—and is now under serious threat