21 March 2018

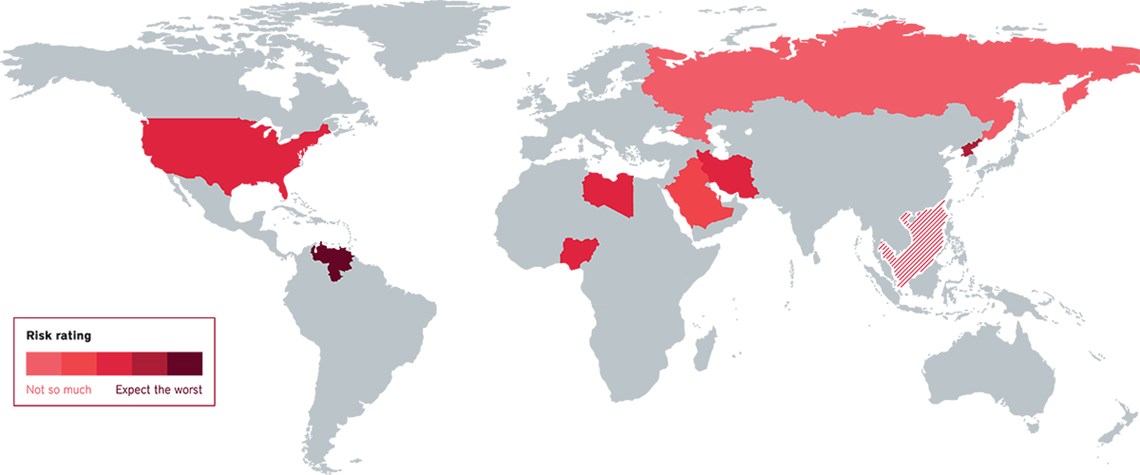

The volatile 10

As the oil market regains balance, risk will affect the price. Here's where to watch

US Unpredictable leader? Global risk now emanates directly from the Oval Office and—on everything from North Korea to Nafta—Donald Trump's Twitter account. For the oil market, the president is broadly bullish. US tax cuts may feed into higher demand; Trump's dislike of the Iran deal and stance on Venezuela may bring sanctions; and an implicit soft-dollar policy could support oil prices. His "American first" programme has not caused the drop in global trade some feared. The main bearish risk from the US comes from the Fed's planned interest-rate rises this year and the impact on the global economy. If Democrats win bigly in November's midterm elections, Trump will be stymied and the Russia in

Also in this section

23 January 2026

A strategic pivot away from Russian crude in recent weeks tees up the possibility of improved US-India trade relations

23 January 2026

The signing of a deal with a TotalEnergies-led consortium to explore for gas in a block adjoining Israel’s maritime area may breathe new life into the country’s gas ambitions

22 January 2026

As Saudi Arabia pushes mining as a new pillar of its economy, Saudi Aramco is positioning itself at the intersection of hydrocarbons, minerals and industrial policy

22 January 2026

New long-term deal is latest addition to country’s rapidly evolving supply portfolio as it eyes role as regional gas hub