This past year has been highly volatile, with diesel—and its variants gasoil and heating oil—being the most pronounced example among refined products. Northwest European diesel premiums to crude oil averaged $40/bl over March–October 2022, with the October average close to $60/bl, according to data from price reporting agency Argus Media. Historically, diesel cracks were usually in the $10-15/bl range, with the last super-spike occurring in 2008, when refineries were seemingly unable to catch up with soaring demand right ahead of the financial crisis.

Multiple factors have contributed to the diesel price surge. As a background factor, the global refining system had difficulties catching up with recovering product demand after the Covid-related slump in 2020. Figures from research firm BloombergNEF show around 3mn bl/d of refining capacity shut in 2020 and 2021 as the negative demand shock turbocharged the general consolidation pattern amid energy transition considerations.

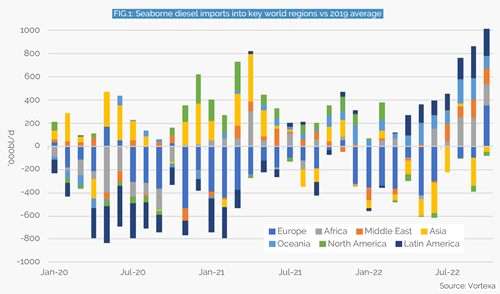

And then diesel prices got a huge push from Russia’s invasion of Ukraine and related sanctions from G7 and EU countries. In fact, actual demand was rangebound in H1 2022, as indicated by overall still lower seaborne import needs relative to 2019 average levels (see Fig.1). But the fear of losing Russian supplies—which accounted for 58pc of European imports from other regions in 2021—was steadily underpinning prices. The situation worsened gradually in late summer and autumn, as the deepening lack of Russian natural gas supplies to Europe raised the stakes for the upcoming winter.

However, European seaborne diesel imports only rose above 2019 average levels with a surge in October. Until then it was Southern Hemisphere markets that steadily and markedly upped seaborne demand for the versatile fuel—with Africa, the Middle East, Oceania (Australia) and Latin America accounting for nearly all the growth. In September, these markets imported 900,000bl/d more diesel than on average in 2019, while Europe, Asia and North America fell 400,000bl/d short of that benchmark. It is doubtful whether all these imports were feeding actual running demand, with the alternative being that some tertiary stock-building took place ahead of what is widely anticipated as Europe’s worst winter in decades.

Diesel question

While these Southern Hemisphere imports look somewhat unsustainable, the big open question is how high European diesel requirements will be over the winter period. Is the October hike in imports only the beginning of much higher requirements as diesel is used as a back-up power and heating fuel amid shortages and high electricity and natural gas prices? Or is the spike of a temporary nature as European buyers take in both Russian diesel supplies until the 5 February 2023 deadline and long-haul replacement barrels from the Middle East, Asia and North America? Much will depend on actual winter weather, but at some point, diesel demand is set to cool, following the precedent of the global economy.

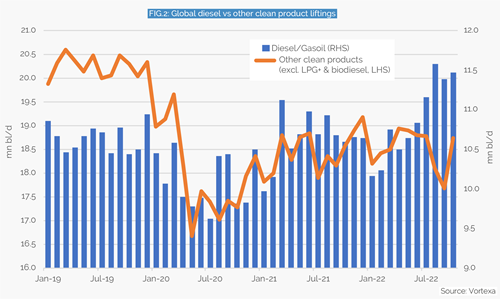

However, there are also substantial adjustments on the supply side, and they are likely to bring down diesel cracks, as well as overall refinery margins, in 2023. Vortexa data shows a substantial hike in the share of diesel in overall clean product liftings—a clear testimony to big yield adjustments at refineries around the globe.

Relative to 2019, diesel liftings have been 830,000bl/d higher over August–October, while other clean product liftings were 2.1mn bl/d lower, increasing the share of diesel from 34pc to 39pc. Given relative diesel versus light distillate pricing developments, this adjustment process is unlikely to be over, with the recent maintenance period unlocking further diesel potential, which is particularly big in petchems- (Asia) and gasoline- (US) focused markets.

Furthermore, China is making strong efforts to kickstart its refining industry with an eye on diesel exports. And finally, grassroots refineries are in their finishing phases around the globe (China, Kuwait, Nigeria and Oman), raising the overall product supply potential. All this is set to amplify diesel and overall product supplies, weighing on diesel cracks and refining economics, especially as demand is set to weaken after the peak winter period.

David Wech is the chief economist at the energy analytics company, Vortexa.

This article is part of the upcoming special report Outlook 2023, which features expectations from the energy industry for key trends in the year ahead. Sign up here to receive updates about the full report.

Comments