More to come in Thailand for Valeura

The Canadian indie is already undergoing rapid growth and is looking for further opportunities in the Southeast Asian country

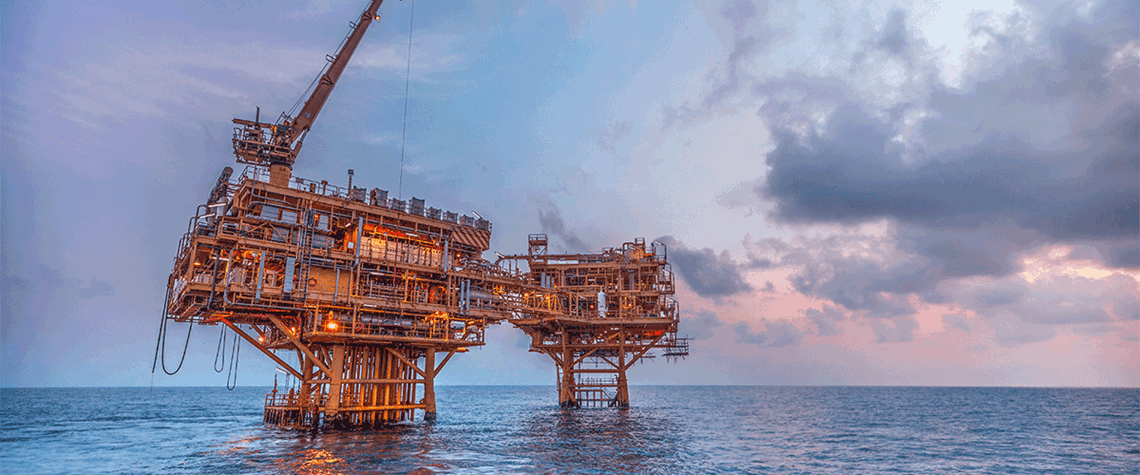

Calgary-based Valeura recently signed a “transformative” SPA with Abu Dhabi’s Mubadala for the state-owned investor’s entire upstream oil portfolio in Thailand. The Canadian independent expects the deal to close this quarter, CEO Sean Guest tells Petroleum Economist. At the time of the deal, the assets’ production totalled “approximately 21,000bl/d from three separate fields”, comprising Jasmine, Manora and Nong Yao, which are in the “mid-to-late” periods of their operational lifespans, explains Guest. “There is still growth potential within this portfolio,” he continues. “While we expect a slow decline in production from the large fields like Jasmine and Manora, we still have the Nong Yao f

Also in this section

23 January 2026

A strategic pivot away from Russian crude in recent weeks tees up the possibility of improved US-India trade relations

23 January 2026

The signing of a deal with a TotalEnergies-led consortium to explore for gas in a block adjoining Israel’s maritime area may breathe new life into the country’s gas ambitions

22 January 2026

As Saudi Arabia pushes mining as a new pillar of its economy, Saudi Aramco is positioning itself at the intersection of hydrocarbons, minerals and industrial policy

22 January 2026

New long-term deal is latest addition to country’s rapidly evolving supply portfolio as it eyes role as regional gas hub