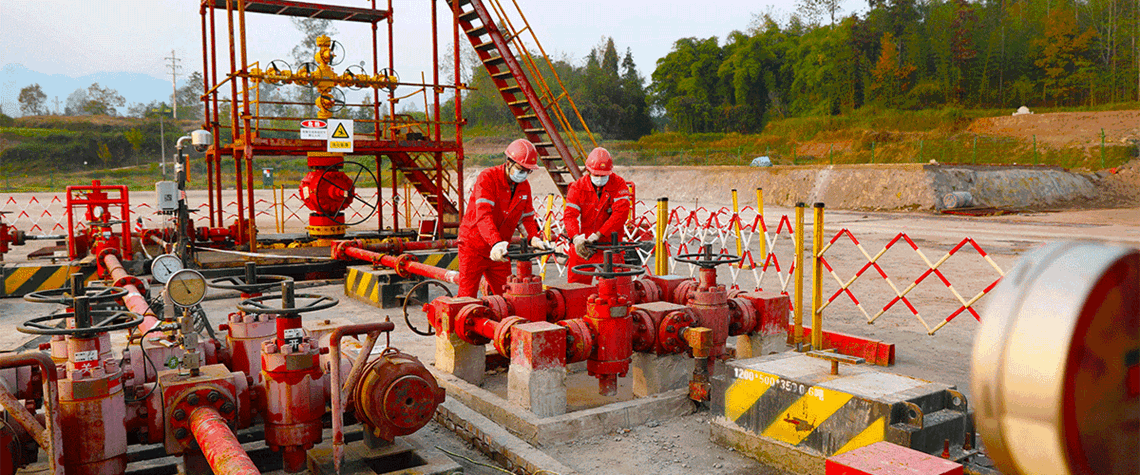

China’s gas goals face unconventional hurdles

Beijing’s strong emphasis on domestic production growth will require heavier investment from the country’s NOCs, as remaining reserves become harder to exploit

China’s domestic gas output will continue to grow for the rest of this decade, as the country’s energy giants eke out greater production at prolific legacy fields. But later gains could become harder to come by, as upstream development will eventually have to shift to complex frontier plays, both onshore and offshore, that are more challenging to exploit. China has managed to increase gas output by more than 10bcm/yr for the past six years, a streak the central government is keen to continue. PetroChina, Sinopec and CNOOC—which together accounted for 83% of gas produced in China in the first nine months of this year—have persistently sustained or increased domestic investment, under governme

Also in this section

23 January 2026

A strategic pivot away from Russian crude in recent weeks tees up the possibility of improved US-India trade relations

23 January 2026

The signing of a deal with a TotalEnergies-led consortium to explore for gas in a block adjoining Israel’s maritime area may breathe new life into the country’s gas ambitions

22 January 2026

As Saudi Arabia pushes mining as a new pillar of its economy, Saudi Aramco is positioning itself at the intersection of hydrocarbons, minerals and industrial policy

22 January 2026

New long-term deal is latest addition to country’s rapidly evolving supply portfolio as it eyes role as regional gas hub