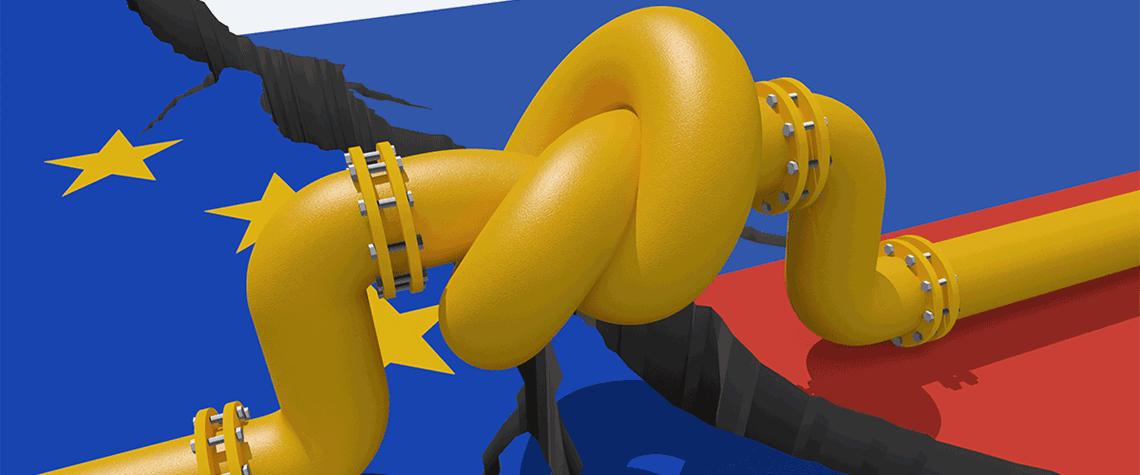

Global gas market reawakened by ‘Russia effect’

Industry takes fresh look at moribund, risky or questionable gas and LNG projects

The ‘Structures A and E’ project off the Libyan coast is as prosaic as its name implies, holding an unspectacular 6tn ft³ (170bn m³) of gas. Plans to extract it date from 2008, but the operator, Italy’s Eni, had been content to leave it in the ground given the upheaval in Libya. That upheaval has not gone away: the country has two rival governments, militias rule the capital and its National Oil Corporation is riven with infighting. But in January, Eni cast those worries aside and announced it was developing Structures A and E. One big reason is the ‘Russia effect’—Europe’s thirst for new gas following the imposition of sanctions on Moscow. Russia supplied half of Europe’s gas before its inv

Also in this section

23 January 2026

A strategic pivot away from Russian crude in recent weeks tees up the possibility of improved US-India trade relations

23 January 2026

The signing of a deal with a TotalEnergies-led consortium to explore for gas in a block adjoining Israel’s maritime area may breathe new life into the country’s gas ambitions

22 January 2026

As Saudi Arabia pushes mining as a new pillar of its economy, Saudi Aramco is positioning itself at the intersection of hydrocarbons, minerals and industrial policy

22 January 2026

New long-term deal is latest addition to country’s rapidly evolving supply portfolio as it eyes role as regional gas hub