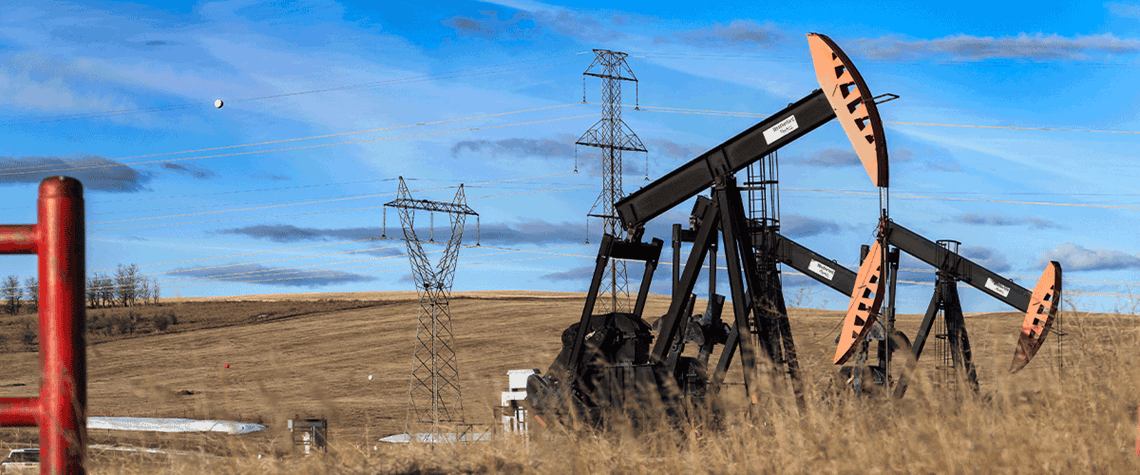

Letter from Canada: Greater volatility ahead for WCS discount

International events, rather than infrastructure bottlenecks, have undermined prices for Western Canadian crude

The price discount for Western Canadian Select (WCS) heavy crude against WTI has blown out in recent months. But the cause has been global events rather than a lack of pipeline and rail takeaway capacity, as was the case during previous price declines in the past decade. For instance, the 3.3mn bl/d Enbridge Mainline pipeline has seen either low or no use since the Line 3 replacement project was completed in October 2021, adding around 370,000bl/d in capacity. And just over a tenth of western Canada’s crude-by-rail export capacity of 1.33mn bl/d has been used in recent months. Instead, fallout from Russia’s invasion of Ukraine has caused a general widening of crude quality differentials the

Also in this section

28 January 2026

The alliance looks to bolster market management credibility by bringing greater clarity and unity to output cuts and producer capacity later in 2026

23 January 2026

A strategic pivot away from Russian crude in recent weeks tees up the possibility of improved US-India trade relations

23 January 2026

The signing of a deal with a TotalEnergies-led consortium to explore for gas in a block adjoining Israel’s maritime area may breathe new life into the country’s gas ambitions

22 January 2026

As Saudi Arabia pushes mining as a new pillar of its economy, Saudi Aramco is positioning itself at the intersection of hydrocarbons, minerals and industrial policy