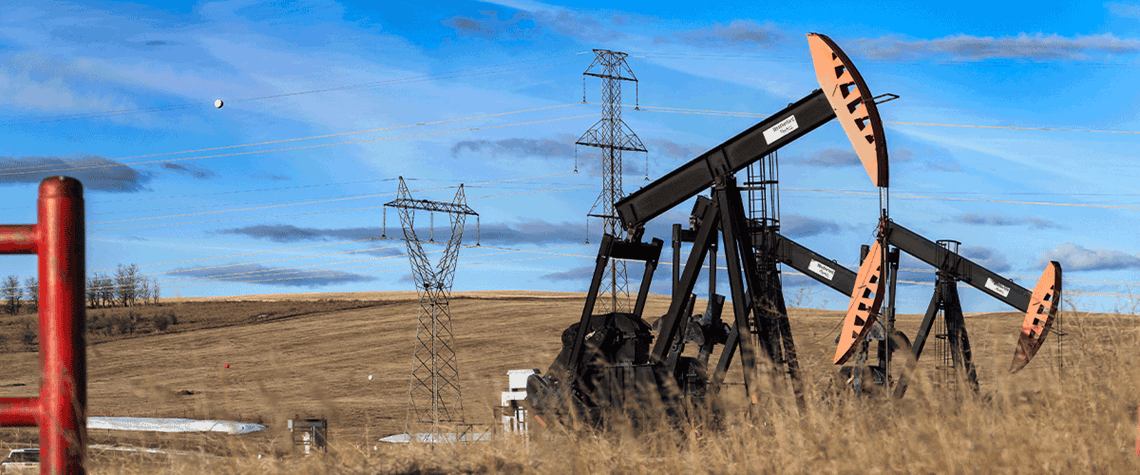

Letter from Canada: Greater volatility ahead for WCS discount

International events, rather than infrastructure bottlenecks, have undermined prices for Western Canadian crude

The price discount for Western Canadian Select (WCS) heavy crude against WTI has blown out in recent months. But the cause has been global events rather than a lack of pipeline and rail takeaway capacity, as was the case during previous price declines in the past decade. For instance, the 3.3mn bl/d Enbridge Mainline pipeline has seen either low or no use since the Line 3 replacement project was completed in October 2021, adding around 370,000bl/d in capacity. And just over a tenth of western Canada’s crude-by-rail export capacity of 1.33mn bl/d has been used in recent months. Instead, fallout from Russia’s invasion of Ukraine has caused a general widening of crude quality differentials the

Also in this section

15 April 2024

Though hampered by methane concerns, US LNG has a crucial role to play for European and Asian energy security, US economic needs and the energy transition drive

12 April 2024

Iran has announced multibillion dollar spending programmes aimed at domestic companies, inspired by recent export success

12 April 2024

CEO Meg O’Neill believes operating environment in Australia has stabilised and sees a bullish outlook for LNG demand

11 April 2024

The renewables revolution is not producing a gas boom in Asia’s largest countries, as incumbent energy sources coal and hydro retain an advantage