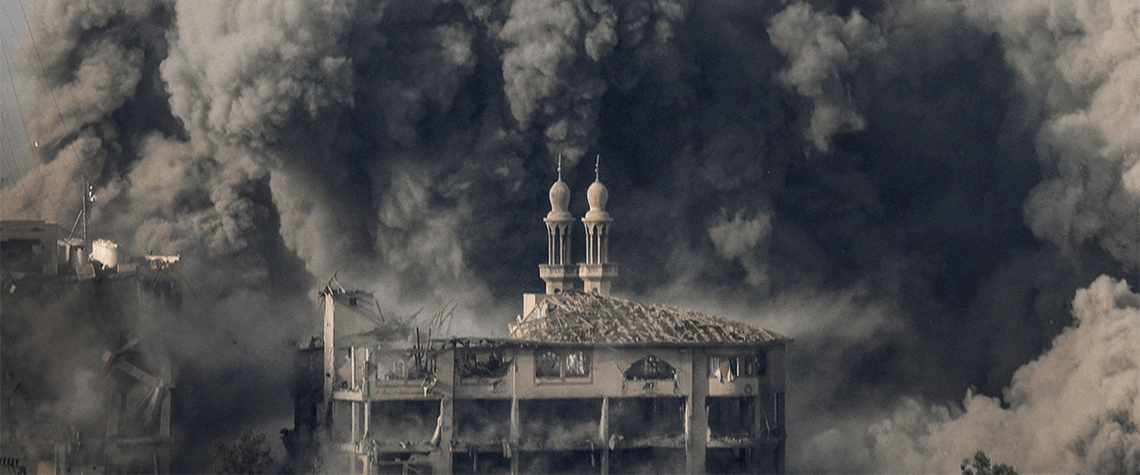

Israel-Hamas war clouds energy prospects

The threat of a big disruption to energy trade in the Middle East appears to be receding, but the fog of war is casting doubt on projects in the region

The war in Gaza may still escalate beyond the borders of Israel and the Palestinian territories and cause major energy disruptions, but the likelihood of this appeared to have receded by early December as a ceasefire came and went and hostilities remained largely constrained to the Gaza Strip and surrounding areas. Instead, experts say, different tracks of negotiations are picking up, with the entire Middle East in flux and Qatar’s status in particular elevated—as both an energy powerhouse and a geopolitical deal maker. Global oil and gas prices spiked immediately after the surprise attack by Hamas on 7 October, which claimed more than 1,200 Israeli lives and disrupted regional energy trade.

Also in this section

26 July 2024

Oil majors play it safe amid unfavourable terms in latest oil and gas licensing bid rounds allowing Chinese low-ball moves

25 July 2024

Despite huge efforts by India’s government to accelerate crude production, India’s dependency shows no sign of easing

24 July 2024

Diesel and jet fuel supplies face a timebomb in just four years, and even gasoline may not be immune

23 July 2024

Rosneft’s Arctic megaproject is happening despite sanctions, a lack of foreign investment and OPEC+ restrictions. But it will take a long time for its colossal potential to be realised